On 29 March 2022, as part of the 2022–23 Budget, the Australian Government introduced a great incentive for small business to accelerate digital adoption.

Here are some key facts regarding how you can benefit from this enhanced tax deduction and some options for improvement to your website, booking, ticketing and business process technology today.

Key Facts – Small Business Technology Investment Boost

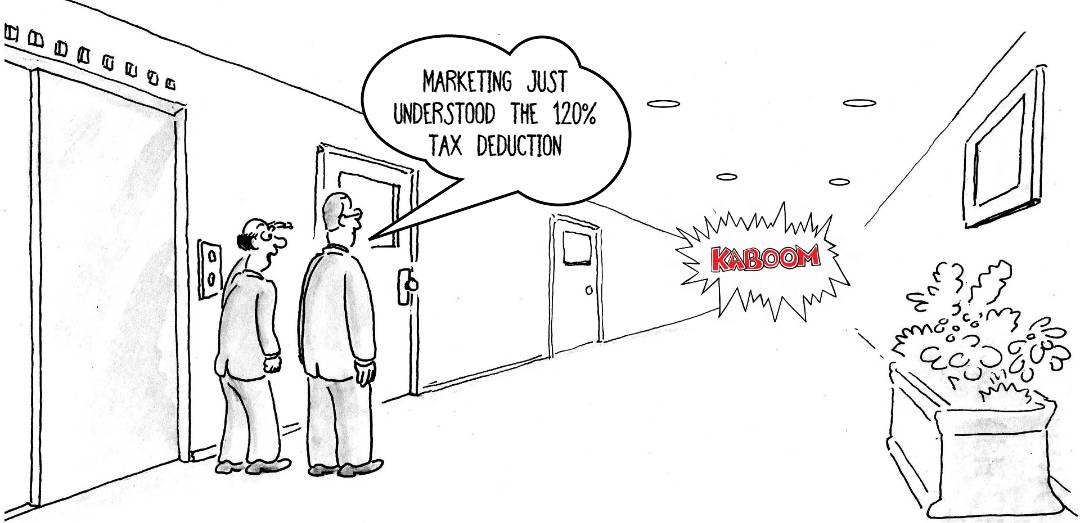

The Australian Government Small Business Technology Investment Boost offers two main benefits to business with turnover less than $50 million:

- 120% tax deduction up to $100 000 cap

- Simplified classification of eligible digital adoption expenses. Now both capital and maintenance expenses are eligible to bundle until 30th June 2023.

This means Australian business with less than $50 million turnover, can claim 120% of their aggregate digital adoption costs, up to $100000 cap during the following two periods:

- For expenses paid and implemented between 29th March 2022 and 30th June 2022

- For expenses paid and implemented between 1st July 2022 and 30th June 2023

Any projects claimed this financial year, must be invoiced between 29th March and 30th June and need implement by June 30th to qualify.

There are many great solution providers for many varied needs. I would like to focus now on the things we can offer that qualify and can be implemented by June 30 for work signed into production by the end of April.

We can build you a new website inclusive of hosting, domain, email and security solution that is free from booking and ticket platform fees, or complete custom development on your existing site with the following functions:

- SME Consultant & SME Venue Websites with bookable calendar hours, integrated with your Google Calendar, banking and accounting software, free from platform fees.

- SME Event Website with ticketed events you can create, publish and manage, directly integrated with your CRM (or we can set up your CRM), free from ticketing platform transaction fees.

- Custom business forms with automation triggers for any field. Examples include quotation forms, sales lead forms, booking forms, business process and survey forms all with automation triggers and various integrations possible. Now is the time to update those paper checklists and reports into digital forms with triggers, automation, transparency, reporting and security.

- POS solutions for WooCommerce stores, very useful if you sell F&B or merchandize at a ticketed event or from a bookable venue.

For an obligation free chat about your needs please contact us here.